Clinton’s odds tumble, Trump hits a high: CNBC CFO Survey

09/20/2016 / By clintonnews

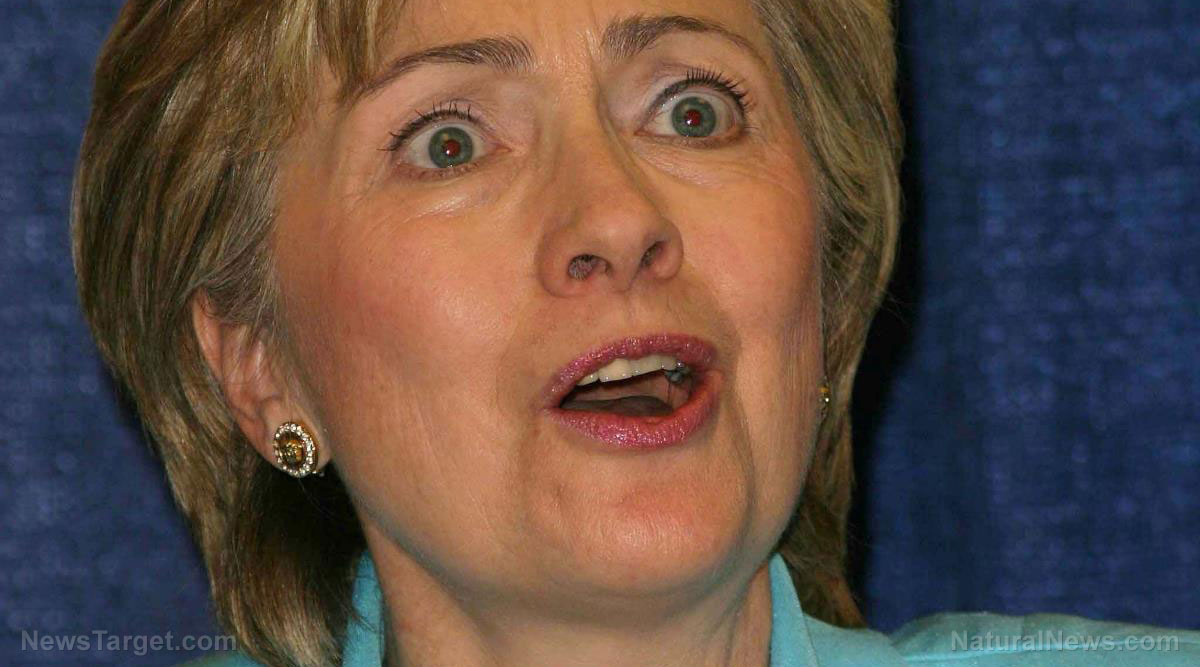

With less than 50 days remaining until the 2016 presidential election, national polls aren’t the only sign the race is tightening between Hillary Clinton and Donald Trump. The possibility of a Trump victory, although still small, has risen among U.S.-based business leaders, while expectations that Clinton will assume the presidency have fallen.

Article by David Spiegel

Regardless of your personal political affiliation, who do you think will be the next President of the United States?

5 US CFOs believe Donald Trump will be the next President, more than any previous survey. However, an overwhelming majority of CFOs still say Hillary Clinton will win.

The CNBC Global CFO Council represents some of the largest public and private companies in the world, collectively managing more than $4 trillion in market capitalization across a wide variety of sectors. The quarterly CFO Council poll was conducted from Sept. 9–Sept. 16.

A separate CNBC Fed Survey, also released Tuesday, showed a big decline among respondents expecting Clinton to win the election, down month over month from 84 percent to 51 percent.

CFOs around the globe also weighed in on some other big global financial concerns, including the timing of the Fed’s next interest-rate move and Brexit.

Don’t expect Fed to rush ahead

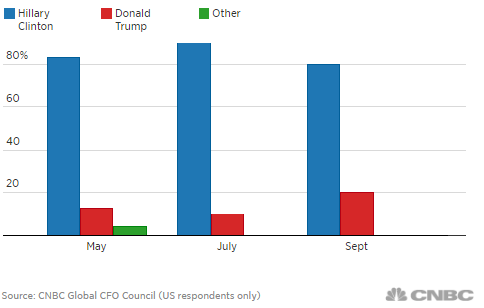

Many CFOs both within the United States and from other regions continue to believe the Fed will raise rates this year, but the percentage of CFOs who expect two more rate hikes is falling.

In the last CFO survey, almost 40 percent of global CFOs expected two hikes from the Fed before year-end, but that has been halved. Now only 20 percent of CFOs expect two hikes this year, while near-70 percent of global CFOs believe there will be at least one rate hike between now and December 31.

Tuesday’s CNBC Fed Survey also shows market expectations for only one rate hike before the end of the year, to come in December.

The Fed Open Market Committee meeting starts today, with FOMC minutes scheduled for release Wednesday.

Trader odds of a September rate hike have come down due to a series of recent indicators suggesting now might not be an opportune time for the Fed to remove support from the U.S. economy.

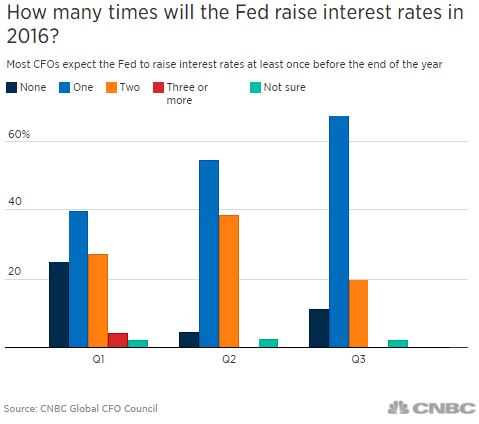

Brexit fallout

CNBC also surveyed the Global CFO Council on imminent repercussions from the decision by the U.K. to leave the European Union. Five out of 46 council member CFOs said the Brexit decision will directly lead to a head count reduction in their company in the U.K. and/or the EU by the end of the year.

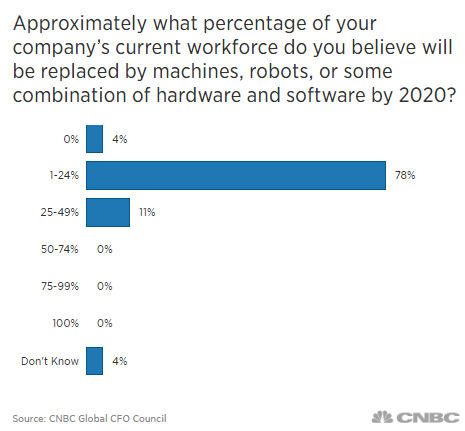

A big read on robots in the workplace

Robots, artificial intelligence and advanced automation are expected to take a significant toll on the human workforce in the years ahead, but expert predictions have been all over the place. CNBC Global CFO Council members were able to offer some big numbers from the current C-suite perspective.

By 2020 the majority of respondents expect that up to a quarter of their firm’s current workforce will be replaced by machines, robots or some combination of hardware and software.

Read more at: cnbc.com

Tagged Under: Clinton, elections 2016, Trump

RECENT NEWS & ARTICLES

COPYRIGHT © 2017 CLINTON NEWS